The French real estate market picks up except in Paris

Standard & Poor’s saw it coming ; in the beginning of the year 2013, the agency published an outlook on real estate markets and as for France, they concluded that long term perspectives were quite positive. They have forecast then a 5% drop for 2013 and 2014 regarding real estate prices. Seven months later, the projections are borne out. Of course, the situation is not as great as one could wish but still, a bright spell in a dark sky is always good news.

The reasons for the said bright spell ? It’s all about the domino effect. The current recession has triggered a drop in real estate prices ; indeed, the crisis has taken a toll on households purchasing power hence, a postpone of the real estate project, fewer demand and a decrease in prices. Also and most important reason for the current situation : the exceptional borrowing incentives. Homebuyers who need financing now benefit from never seen before interest rates. The interest rate for a 20 year loan is 2.95% and 2.60% for a 15 year loan while in December 2012, they were respectively 3.70% and 3.30%.

In 2012, French property prices decreased by 1.9% and for the first semester of 2013, they have already reduced by 2.6% thus enabling many French people to become homeowners. The lower socio-economic classes have taken advantage of such conditions who account for 41.4% of the transactions.

The homebuyer profile is different in Paris, a very particular region where the price per square metre is one of the highest in the country. In the City of Lights, 31.5% of homebuyers were from middle management, whose proportion has increased compared to 2012. In the meantime, the proportion of homebuyers over 50 years old has declined. Most of them do not want to reduce the price of the property they’re selling consequently; they do not sell and cannot afford another property (a similar trend has been noticed in London). In Paris, prices have soared by a spectacular 180% over the past ten years and despite a more important reduction in prices than anywhere else in the country (-3.2% over the past 12 months), purchases have decreased by 5.2% in the first semester of 2013, compared to last year. In the French capital, the average price per square metre has fallen back to its 2011 level, which was €8206. In addition, decreasing prices and low interest rates enabled homebuyers to buy more for less : even if the average sum of purchases has reached an all-time high, €402,016 for a property comprising 49.8sqm of living space, it is still 2.4 additional square metres in twelve months.

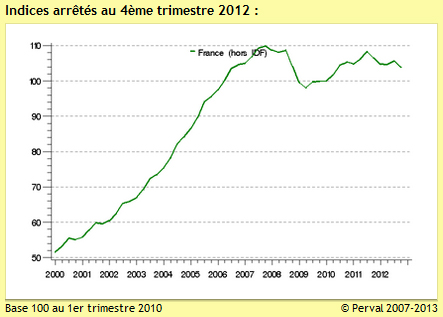

Regarding the price per square metre over the same period in other French regions, the result is the opposite of last year that is to say : if prices were decreasing, they are now rising and if they were rising, they are now making a pause like in Ile de France (-2.2%), Lower Normandy (-8.8%), North, Brittany, Alsace and 13 other French regions. On the other hand, prices have soared in Aquitaine (+5.3%), Burgundy (+5.2%), Limousin (+6%) and in Poitou-Charentes. All of the popular regions for the British clientele. But do not despair! The price index of these regions has been stable since 2007, meaning a certain balance is currently being restored and that’s some good news!

As for old properties, sales have increased by 6.6% between January and June 2013 after a 25% drop in 2012. On the contrary, the sales of investment properties sold to French keep on declining (-6.1% over the last 12 months after a 5.2% drop the year before). The amount of sales is now back to what it was in 2010. Proportion wise during the first semester of 2013, main residences have represented 7 out of 10 purchases (70.6%), second homes 1 purchase out of 10 (6.9%) and investment properties less than 2 out of 10 purchases (16.7%).

French Land registry:

You can easily check the French land registry report per region (it is updated byt the notaires de France). For example, in Brittany, resale house prices have been stable since 2007: Click here to see the graph

You can see the results per region here: French Property price trends by region

All in all, it is very encouraging because long term perspectives are positive as noticed by Standard & Poor’s. Indeed, for the moment, sales are slowly picking up but in the years to come, a significant increase in the sales is planned. All those who were waiting to buy because they were planning to buy at bargain level after a crash like it happened in Spain are slowly coming back on the market. The crash didn’t happened thanks to the strong internal demand because France has a shortage of properties and that is why they try to push developers to build 500,000 properties per year and for example only 350,000 were build last year. This is also one of the reasons young French families are moving out of the cities and prefer to have a better quality of life by living at 20-30mn from a city and benefit from a larger property with a decent size garden for the same budget.